Top line growth strategy and implementation of Insurance, Brokers and MGAs

Sales

Track and capture your leads from different sources into a unified database, ensure automated data verification, and design your own unique lead management process for the best conversion rates.

Manage your opportunities with highly granular processes that help you define and follow through the most optimal strategy for each potential client.

Track and manage internal and external referrals, and easily create powerful referral programs to generate new business from an existing pool of customers.

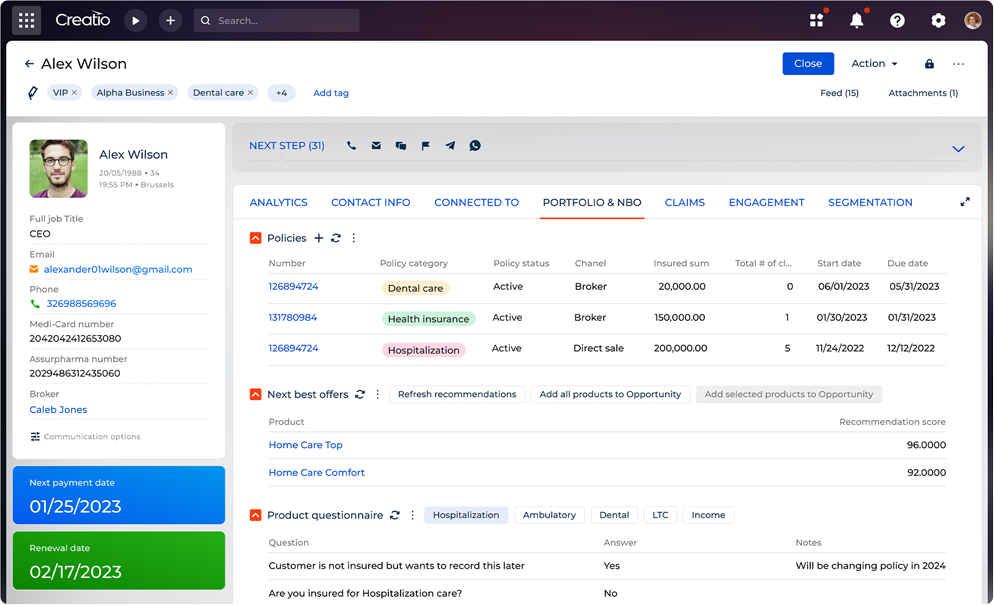

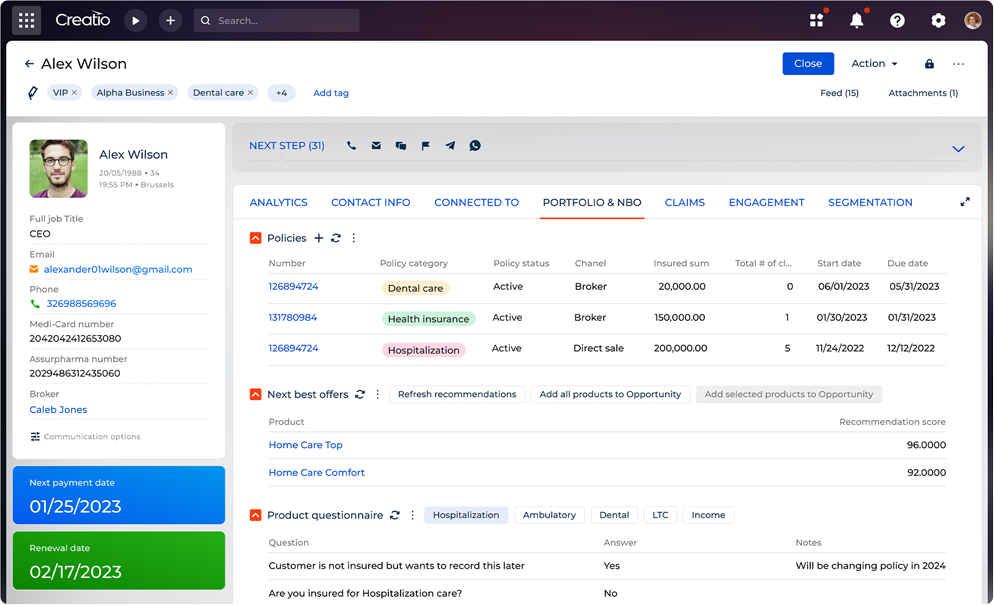

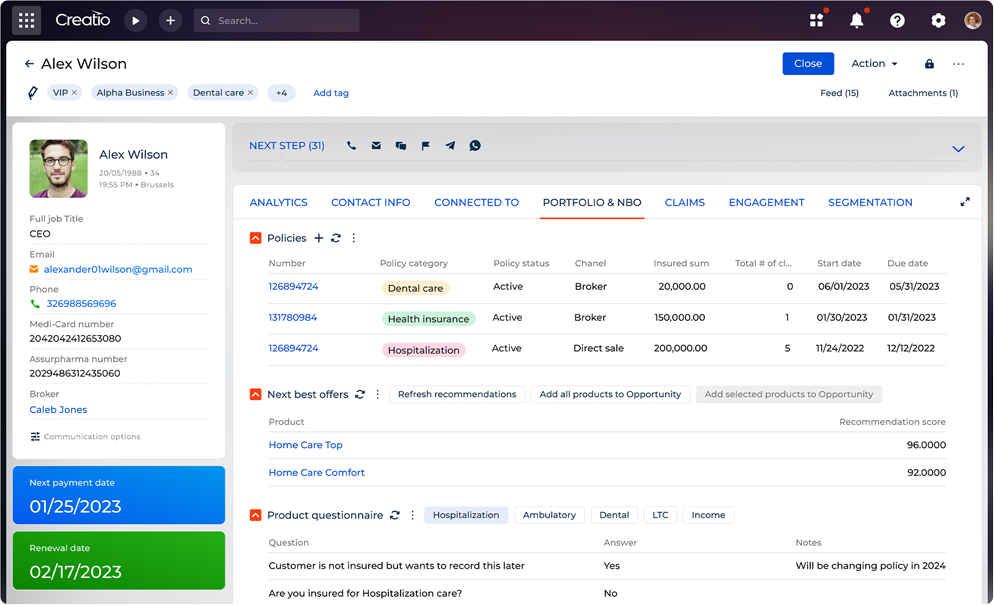

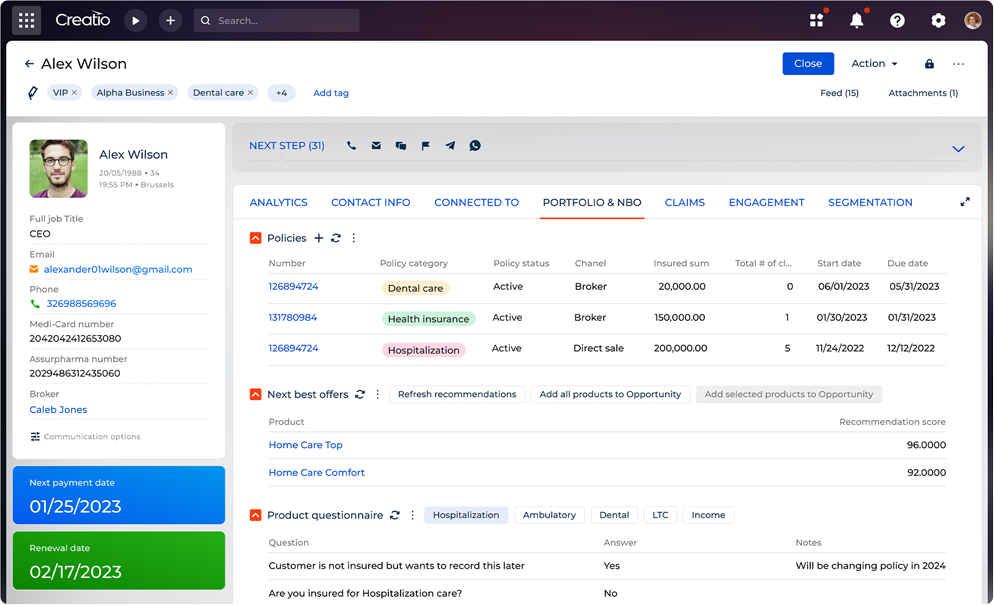

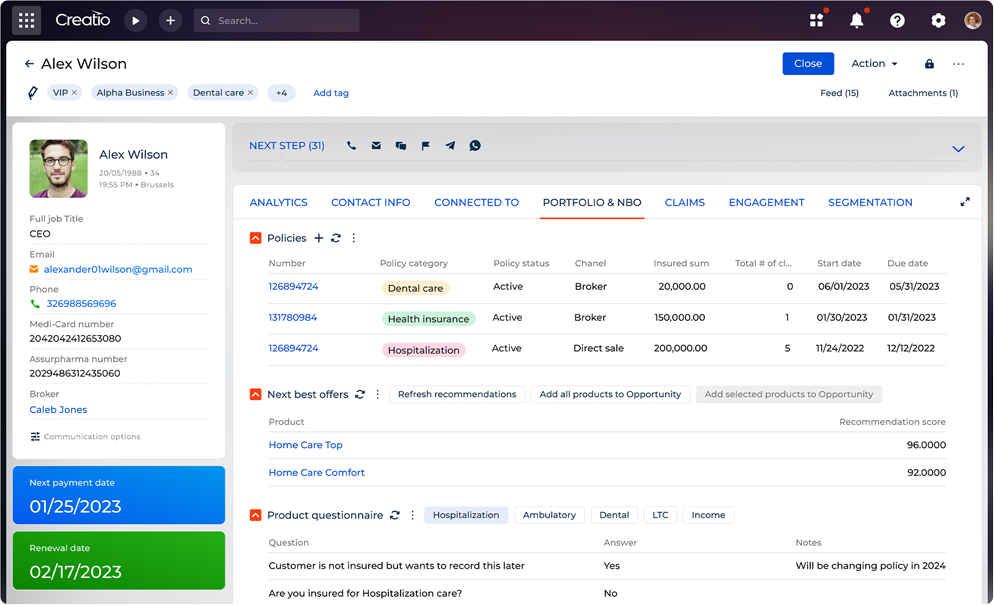

>Boost customer engagement and build long-lasting relationships with your clients by making highly personalized value propositions based on predictive scoring, AI/ML-powered next-best-offer intelligence, and client's history of previous interactions.

Empower your insurance agents with the ability to manage their daily tasks, customer requests, and communications in a unified digital environment that minimizes distractions and ensures maximum productivity.

Marketing

Set up flexible customer segmentation by various criteria and engage your audience with personalized offers in the right channel, at the right time.

Ensure strong lead generation and brand awareness by designing, executing, and optimizing omnichannel marketing campaigns for various markets and geographies at scale.

Improve customer retention with a full-fledged automated loyalty bonus program, integrate and manage multiple loyalty solutions in one place, and analyze loyalty program KPIs to ensure steady growth.

Streamline organizational processes for corporate and client-focused events, as well as tap into high-potential lead pools by executing effective marketing campaigns tailored for industry events and trade shows.

Onboarding

Have a 360-degree view of your customers, including their history with your insurance company, current insurance plans, loyalty programs, AI-powered predictions for potential next best offers and plan upgrades, etc.

Provide a personalized customer journey experience for each client with an in-depth customer profile analytics, needs analysis, predictive scoring, similar cases suggestions, and other AI-driven insights.

Automate processes related to first-time customer onboarding and ongoing support, easily maintain your insurance plans up-to-date, streamline screening and verification routines, speed up approvals, and digitize document management to eliminate errors and maximize customer satisfaction.

Maximize customer satisfaction and lifetime value with AI-driven next best action recommendations that help your managers to take the right course of action for each customer.

Underwriting and verification

Have full visibility of insurance application data to streamline underwriting processes and empower underwriters with in-depth analytics for approving, postponing, rejecting the application, or changing the final financing terms.

Ensure in-depth verification of insurance application data with flexible checklists and automated review/approval workflows, manage priority-based verification queues, speed up the final approval by minimizing manual data entry, setting reminders, and organizing collateral documents.

Keep a well-organized, transparent document management system to ensure centralized access to customer documents, version tracking, elimination of duplicates, automated synchronization of documents across multiple workflows, and flexible access rights management.

Claims processing

Automate an insurance claim lifecycle of various types and enforce efficient digital workflows to review, investigate, and resolve claims.

Collect various customer data from multiple channels, including social media, phone call scripts, third-party investigators, etc. into a single view to simplify investigation processes, prevent fraud, and achieve maximum transparency.

Digitize claims adjustment workflows and policies to deliver personalized and transparent approach for each client based on the company's best practices, simplify in-field work of your agents with a fully-featured mobile app.

Offer your customers maximum transparency and satisfaction by providing all data they need to make a better decision on their claim adjustment or changing their insurance products and plans.

Policy administration

Orchestrate and automate insurance policy lifecycle, reduce time-to-market for new insurance products, and tap into collected customer insights to deliver better customer experiences.

Effectively manage risk by consolidating diverse risk data in a single system, automating risk management workflows, and applying rich AI models for predictive scoring and intelligent next-best-action suggestions.

Ensure across-the-board data consistency and regulatory compliance.

Achieve perfect transparency and efficiency by consolidating multiple policy administration apps and data stores into a single environment.

Employee experience

Implement unified and transparent HR workflows for efficient employee management, including hiring, onboarding, development, retention, and exit.

Improve the employee experience by providing a user-friendly solution to automate all types of requests (vacation, travel, expenses, etc.)

Centralize communications, collaborate, share knowledge and documents, plan your tasks and meetings, manage reviews and approvals.